Don’t feel the heat – designing heat insurance for farmers

This blog was written by Janic Bucheli, PhD student at ETH Zürich, Robert Finger, professor at ETH Zürich and Tobias Dalhaus, assistant professor at Wageningen University & Research.

Heat stress is an increasing production risk for crop farmers in Europe, which can lead to substantial financial losses. The relevance of heat stress for agriculture is exacerbated through climate change. Crop insurance solutions can compensate the financial losses and thereby complement agronomic risk management options on the farm. The insurability of heat stress is, however, challenging, and thus currently not available to farmers.

In a new article that has been recently published in Food Policy, we present a heat index insurance design that increases the risk reducing capacity of heat insurance by making use of empirically estimated payout functions. In a case study with 84 wheat and 81 rapeseed farmers in the eastern part of Germany we illustrate the practical benefits of this new payout function. In our case study region, a non-subsidized index insurance market exists, which however currently does not cover heat risk.

Climate change adaptation

Weather index insurances are particularly useful to cover heat stress because the payout does not depend on an actual loss assessment on the farm but is based on a weather index (e.g. temperature measured at a weather station). This is particularly efficient and reduces transaction costs for those perils that affect agricultural production at a large spatial scale. Additionally, for this type of insurance incentives for the farmer to maintain production levels and apply management strategies that reduce the financial consequences of heat stress, such as irrigation, remain. Index insurance can even be designed to cover additional costs of heat related management efforts, making it especially suitable for climate change adaptation.

The biggest adoption hurdle of index insurances is the so called basis risk. This reflects any discrepancy between the actual damage on the farm and the weather induced payout. Thus, basis risk refers to any difference between payout and on-farm loss, which can be positive (overpayment) or negative (underpayment). To reduce the basis risk, the insurance design, which determines the amount of money paid out to the farmer conditional on the weather, is crucial. Usually suggested payout functions do not consider crop specific and non-linear effects of temperature on crop yields and mostly ignore within-day temperature variation. In our paper, we therefore propose to capture these effects in the payout function.

Financial risk reduced by 20%

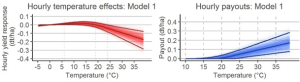

We integrate a cutting-edge statistical method (restricted cubic splines) in the payout function, which uses hourly temperature exposure on the farm as model input and allows for non-linear payouts. To inform the payout function we use regression modelling and estimate the non-linear relation between hourly temperature exposure during critical growth phases and yearly crop yields, which more precisely estimates heat impacts compared to earlier approaches. Figure 1 shows the effects of temperature exposure along different temperatures on wheat yields (red) and the respective insurance payout (blue). We find that yields respond negatively to temperature above 24°C in critical growth phases, which we use to trigger payouts from this temperature upwards. Based on this estimation we simulate payouts for 84 wheat and 81 rapeseed producers and test for the resulting risk reduction.

Figure 1: Hourly Temperature effects on wheat yields (red) and resulting insurance payouts (blue). Inner line shows the estimated temperature effect (red) and payout (blue) and outer lines illustrate the 95% confidence interval.

First, our results confirm that heat stress indeed is a big issue and leads to yield reductions in wheat and rapeseed production in eastern Germany. Second, we find that the here proposed heat insurance reduces the overall financial risk by 20% at the median. Since we only aim at reducing the financial exposure to heat risk, this reduction can be considered substantial as various other factors contribute to the stochasticity of crop yields. Third, we show the flexible applicability of our insurance design, which includes the potential to reduce transaction costs and provides incentives to apply agronomic heat risk management.

In conclusion, our approach increases the attractiveness of index insurance in general and heat insurance in particular and contributes to close a relevant insurance protection gap in the European food production system. This provides entry points for industry and policy to support farmers adaptation to increasing heat stress.

Read more:

- Temperature effects on crop yields in heat index insurance. Bucheli J., T. Dalhaus, R. Finger. In: Food Policy.

- Previous blog: What do two decades of agricultural insurance research tell us?

Good job. Very interesting paper